section 4 income tax act malaysia

The new section 44ADA which was inserted into the 44AD of the Income Tax Act brings the professionals into the purview of the tax relief. Form BE refers to income assessed under Section 4 b 4 f of the Income Tax Act 1967 ITA 1967 and be completed by individual residents who have income other than business.

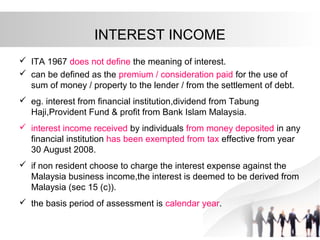

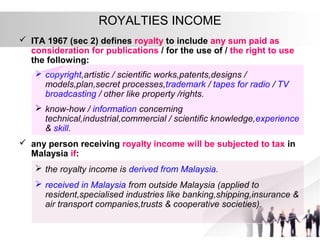

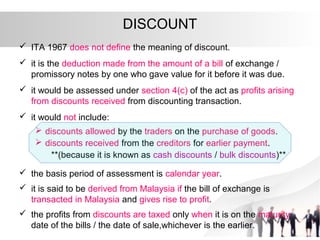

Taxation Principles Dividend Interest Rental Royalty And Other So

The presumptive assumption rate is 50 for the freelancers.

. Association or body which is or was assessable or was assessed as a company for any assessment year under the Indian Income-tax Act 1922 11 of. How Does Monthly Tax Deduction Work In Malaysia. While donating towards Akshaya Patra you as an individual or a corporate can claim for a 50 deduction at the time of filing your income tax return.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Charge of income tax 3 A. Tax Offences And Penalties In Malaysia.

How To Pay Your Income Tax In Malaysia. All about tax deductions and the net paid income are detailed in Form 16 that the employer must provide to the employee. Theres even a tax relief for alimony payments.

The Government of Malaysia is fairly reasonable allowing us to get personal tax reliefs from lifestyle expenses such as gadgets and sports equipment to mandatory ones such as education and medical expenses for our parents and ourselves. Short title and commencement 2. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. Non-chargeability to tax in respect of offshore business activity 3 C. Donate to Akshaya Patra save tax.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Guide To Using LHDN e-Filing To File Your Income Tax. For the full list of personal tax reliefs in Malaysia as of the.

As per Section 192 of the Income Tax Act the employer will withhold taxes if the employees do not come within the taxable bracket. Income from Capital Gains. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

The Foundation is registered under Section 12A a of the Income Tax Act 1961 and is registered under the Indian Trusts Act 1882. Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Agreement Between The Government of Malaysia and The Government of the Republic of India for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income. Hence on Rs 100 turnover the profit will be assumed to be Rs 50.

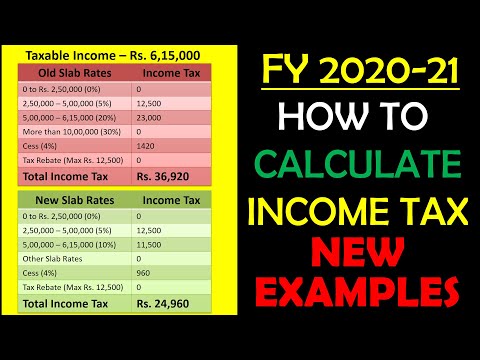

How Is Taxable Income Calculated How To Calculate Tax Liability

What Is Speculative Transactions Under Income Tax Act Enterslice

Taxation Principles Dividend Interest Rental Royalty And Other So

Extended Compliance Due Date Under Income Tax Act 1961 And Income Tax Rules 1962 Tax Rules Compliance Taxact

How To Check Income Tax Notice Online Enterslice

Income Tax Act 1961 A Comprehensive Overview Ipleaders

Tax Deduction On Income From Mutual Fund Section 194k Of Ita

What Is Local Income Tax Types States With Local Income Tax More

Everything About Section 12 Of Income Tax Act 1961 Enterslice

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Taxation Principles Dividend Interest Rental Royalty And Other So

Section 9 Of Income Tax Act 1961 Income Deemed To Accrue In India

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

How Is Taxable Income Calculated How To Calculate Tax Liability

No comments for "section 4 income tax act malaysia"

Post a Comment